401k rmd tables

Ad You Can Roll Over Your Old 401k into a TD Ameritrade IRA in 3 Simple Steps. This is your required minimum distribution for this year.

Rmd Table Rules Requirements By Account Type

Ad If you have a 500000 portfolio download your free copy of this guide now.

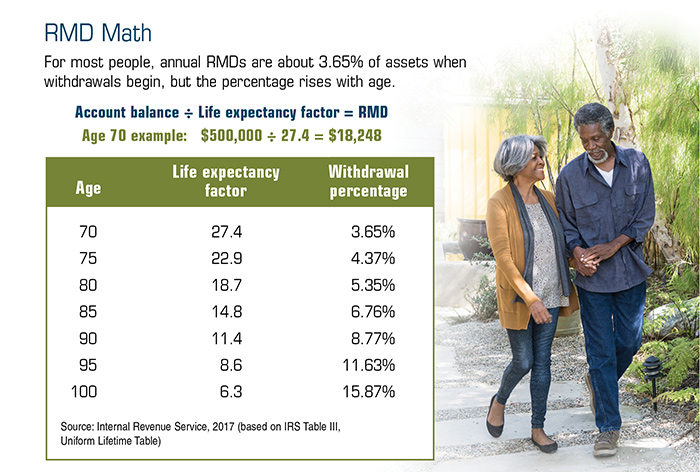

. The distribution period or life expectancy also decreases each year so your RMDs. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Thats the RMD amount that you.

Year you turn age 72 70 ½ if you reached 70 ½ before January 1 2020 - by April 1 of the following year. Use this calculator to determine your Required Minimum Distribution RMD. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Therefore Joe must take out at least 495050 this year 100000 divided by 202. Ad 10 Best Lenders to Rollover Your 401K into Gold IRA. Line 1 divided by number entered on line 2.

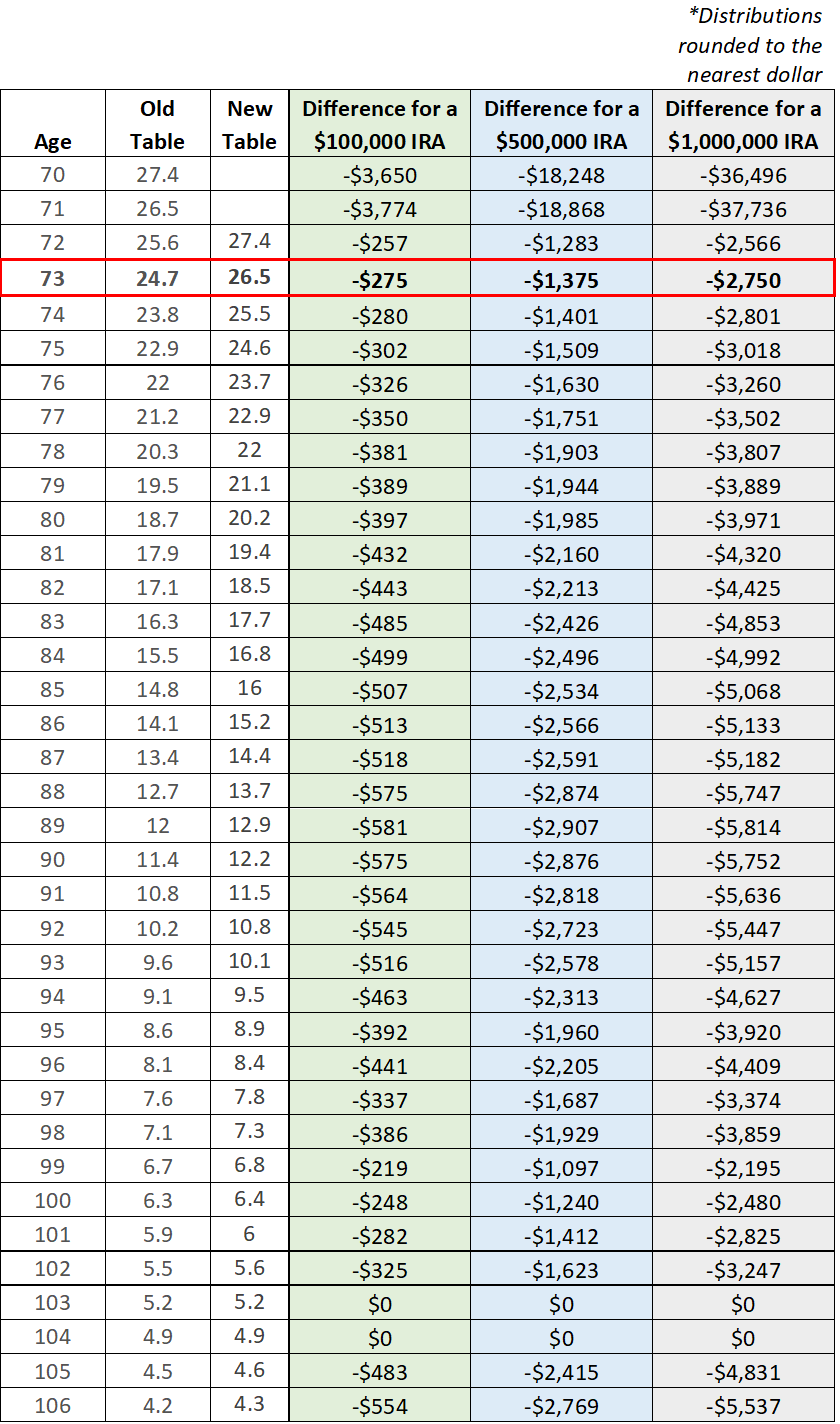

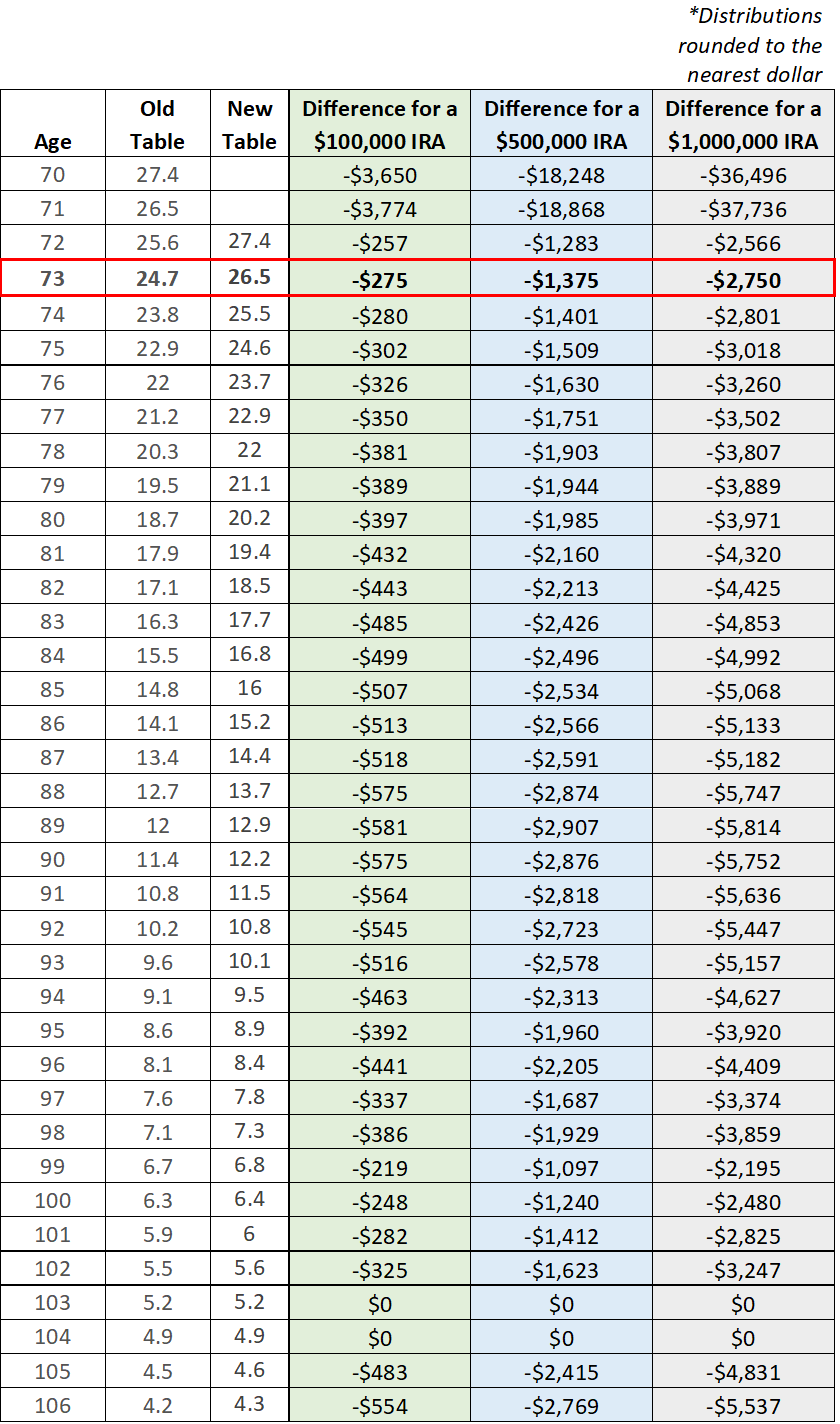

They did that and published a new set of RMD tables for years starting on or after January 1 2022. Were happy to have the new tables available. The IRS implemented new Life Expectancy Tables on January 1 2022 for use in calculating required minimum distributions from accounts that qualify.

Please ensure that youre referring. Deadline for receiving required minimum distribution. These new tables will lower RMDs slightly for most ages.

Ad Yieldstreet specializes in investments beyond the stock market for retail investors. This guide may be especially helpful for those with over 500K portfolios. Ad Use This Calculator to Determine Your Required Minimum Distribution.

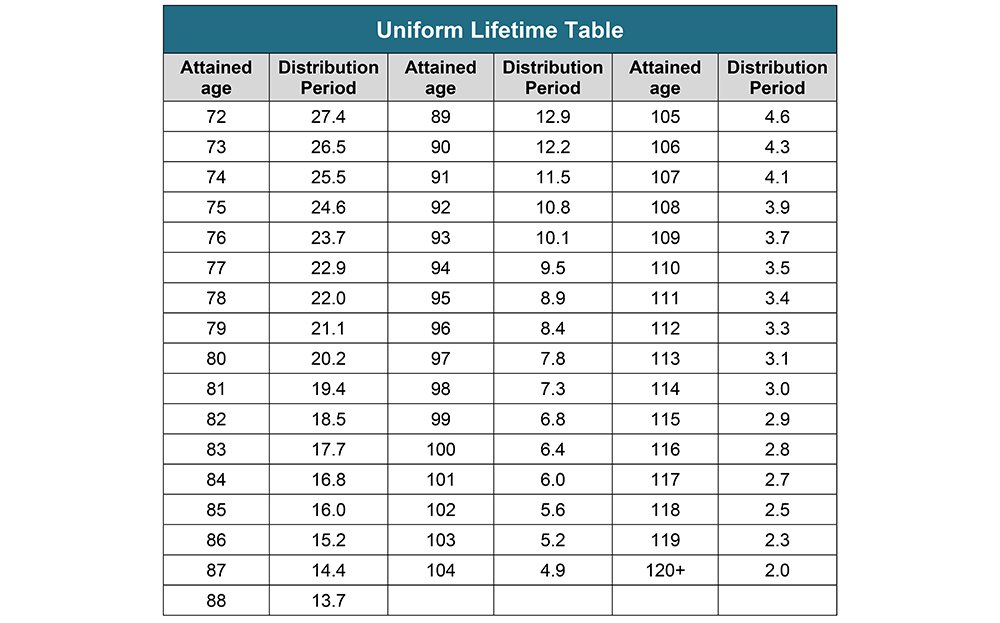

This guide may be especially helpful for those with over 500K portfolios. Here is the distribution period for every range from 72 to 115 according to the RMD worksheet. Divide 500000 by 255 to get your 2022 RMD of 19608.

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. For an IRA with a balance of 700000 on 12312021 the difference in RMD is 28455 new table versus 30568 old table. Learn why over 400K members have invested over 3 billion with Yieldstreet.

A required minimum distribution or RMD is an amount the IRS requires taxpayers to withdraw from their pre-tax retirement accounts once they reach 72. Ad If you have a 500000 portfolio download your free copy of this guide now. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution -.

Distribution period from the table below for your age on your birthday this year. Protect Yourself From Inflation. To calculate your RMD look up the distribution period for age 74 which is 255.

Since a retiree will have a different RMD after 72 it must be calculated every year. RMDs are a way for. All subsequent years - by.

A Guide To Required Minimum Distributions Rmds

Required Minimum Distributions Tax Diversification

Rmds Required Minimum Distributions Top Ten Questions Answered Mrb Accounting 516 427 7313

Sjcomeup Com Rmd Distribution Table

How Required Minimum Distributions Work Merriman

What Is A Required Minimum Distribution Taylor Hoffman

Rmd Table Rules Requirements By Account Type

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Your Search For The New Life Expectancy Tables Is Over Ascensus

Where Are Those New Rmd Tables For 2022

Your Search For The New Life Expectancy Tables Is Over Ascensus

What Do The New Irs Life Expectancy Tables Mean To You Glassman Wealth Services

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Is There New Required Minimum Rmd Tables For 2022 Michael Ryan Money Financial Coach

Required Minimum Ira Distributions Will Resume In 2021 Heintzelman Accounting Services

Calculating Required Minimum Distributions

Required Minimum Distribution Rules Alpha Wealth Advisors Llc